As a hub of technology and innovation, there is no better idea than to start software company in Dubai. Its business-friendly environment, low tax rate, and multicultural population secure a favorable outcome for entrepreneurs.

In this article, we will explore the benefits of starting your own software company. Additionally, we will outline the costs, licensing procedures, and provide a detailed, step-by-step guide on how to start a software company in Dubai. With this information, you will be exceptionally prepared, as success will be guaranteed.

Benefits of Start a Software Company in Dubai, UAE

With technology advancing at such a rapid pace, the UAE remains the cradle of progress and modernization. This means that the best opportunity to contribute to its technological growth and to skyrocket your opportunities of success is to open a software company in Dubai.

- Dubai is a multicultural city, steadily welcoming foreign visitors and international entrepreneurs. Consequently, not only is the demand for new tech services growing exponentially every day, but the market will remain vast and ever-changing. Additionally, its strategic location and varied time zones streamline networking and collaboration with other tech hubs around the world. This can open up opportunities for both international partnerships and global market reach.

- Not to mention, both the public and the private sectors actively support the overall growth of the software sector. This support can include initiatives, incentives, and resources to help businesses thrive, as well as endless work opportunities.

- Besides, many government institutions have developed websites and software alternatives to their procedures. For example, one of their initiatives includes digitization and automation in police stations, allowing residents to pay fines and report accidents without having to speak to an officer.

- Furthermore, Dubai is actively seeking and refining emerging technologies. These technologies include blockchain, AI, machine learning, and IoT. Several sectors, including waste disposal, traffic congestion, energy consumption, and air pollution, are adopting data-sharing and collecting smart technologies.

- Moreover, the UAE has the lowest corporate tax rate within the GCC, being 9% in most of the territory and 0% in Free Zones. This is incredibly beneficial, since it can help maximize profits that you can reinvest in your software company in Dubai.

Dubai is the city of tomorrow, so you cannot miss the opportunity to make it the home of your new software company.

Software Company License in Dubai and Across the UAE

Obtaining a software company license is a fundamental step in starting a software company in Dubai. The Department of Economic Development (DED) is the authority responsible for issuing them in mainland Dubai. Otherwise, you will have to turn to the Free Zone Authority (FZA) for that.

- First, you must provide the relevant documents. These include a business plan, proof of address, a copy of your passport, and evidence of the financial stability of your company.

- Then, depending on the nature of your software company, you will need to present additional permits and licenses, such as a commercial license, a work permit, and a value-added tax (VAT) registration.

- Lastly, you must register your company with the Dubai Chamber of Commerce and Industry and the Dubai Municipality. This offers a range of services, networking opportunities, and advocacy support. In addition, it can enhance your credibility and provide access to a favorable business environment in Dubai.

The DED or FZA will review your application and documents and issue the license once all procedures are completed. Generally, it can take anywhere from three days to four weeks to receive approval for a company license. As soon as you do, you will be more than ready to launch your software company in Dubai.

Cost of Software Company License

As it was already mentioned, a company license, also referred to as a business license or company registration, is an official document that grants permission to a company to operate within a specific area. It is acquired from the corresponding government authorities (the DED or the FZA), and you must pay a fee in order to request it.

Specifically, the cost of a software company license in Dubai varies. It can fluctuate depending on the complexity or the type of the software company, different licensing terms, and the specific vendor.

However, the cost might range from 5,500 AED to 21,185 AED depending on your jurisdiction and business activities, as well as your company’s size.

Cost of Starting a Software Company in Dubai Mainland

In order to calculate the general cost of starting a software company in Dubai, there are diverse factors to take into account. There are several individual fees you must pay aside from the general investment required to start a business. Consequently, it cannot be narrowed down to a single figure. However, it is possible to estimate some minimum general costs:

- Initial Approval Fee: One-time payment of 120.00 AED.

- Name Approval Fees: One-time payment of 620.00 AED.

- Tasheel Fees: One-time payment of 345,00 AED.

- Notary Verification Fees: One-time payment of 350.00 AED.

- MOA/LSA-Notary Fees: One-time payment of 1,200.00 AED.

- License Fees Approximately: Part annual payment of 12,500.00 AED.

- Immigration Card Fees: Annual payment of 750.00 AED.

- Stamp of the Company: One-time payment of 100.00 AED.

- Labour Card Fees: One-time payment of 1,000.00 AED.

- Investor Residence Visa Fees: Part two-year payment of 4,200.00 AED.

That can result in an estimated cost of 21,185 AED. In addition, if you are starting the business by yourself as a sole proprietorship, the initial setup cost is likely to be around 15 to 20,000 AED, plus an annual renewal fee.

On the other hand, if there is more than one shareholder, the cost might be around 50,000 AED. That includes if you will have several staff, as well as a larger office space. Other fees, such as documentation fees, legal fees, and office space rental costs, may be involved in addition to the stated fee. Nonetheless, this is an approximation of the minimum you will need to get your company started.

Cost of Starting a Software Company in the UAE Freezone

In addition to all the factors already mentioned that can affect the cost of starting your software company in Dubai, you must keep in mind that these costs can vary based on the type of business activities you plan to carry out, the number of visas you require, and the location of your office. For this reason, starting a software company in a Free Zone will set a different budget.

Free Zones in the UAE are designated areas that have their own set of regulations to attract foreign investors. Some benefits of setting up a business in a Free Zone include total ownership, tax exemptions, simplified recruitment, and access to exceptional facilities. Each Free Zone is dedicated to specific business categories and offers different types of licenses. Thus, fee payments and procedures may be different, but it is still difficult to pinpoint a specific sum.

However, it is possible to calculate the total cost of procedures in Free Zones for an assessment:

- License fees: Annual payment of 5,500.00 AED

- Immigration Card Fees: Annual payment of 2,000.00 AED

- Stamp of the Company: One-time payment of 100.00 AED

- Investor Residence Visa Fees: Part two-year payment of 5,000.00 AED

All of this for a roughly estimated total cost of 12,600 AED.

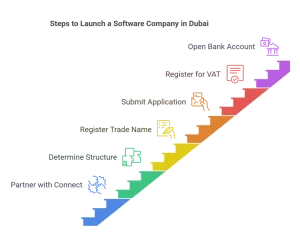

How to Start a Software Company in Dubai: Step-by-Step

Having carefully examined the above information, we are ready to provide a detailed, step-by-step guide on how to start the best software company in Dubai. Now, let us delve into the detailed process for establishing your software business in this thriving city.

Step 1: Partner with Connect Business Centers

If you want to succeed with the best software company in Dubai, the first thing you need to do is partner with Connect Business Center.

With our help, you will gain access to exceptional counseling services, accurate up-to-date information, and state-of-the-art office spaces. Our expert guidance will ensure that you have the best support and advice to launch your entrepreneurial venture successfully. Do not miss out on this opportunity to receive the assistance you need! By joining forces with us today, you can set yourself up for guaranteed business success.

Contact us now to start our journey towards maximizing your business potential together!

Step 2: Determine the Business Structure

It is very important for entrepreneurs to evaluate their long-term goals and desired level of control over their business to pick the best structure. This is because each option offers different approaches, benefits, and drawbacks. Some of the possible choices include sole proprietorship, partnership, limited liability company (LLC), or branch office.

- For example, a branch office would work as an extension of a foreign parent company, while an LLC offers limited liability protection. This allows for more flexibility in the general distribution of profit.

- In contrast, a partnership entails joint ownership, shared responsibilities, and the division of profits among two or more individuals; whereas sole proprietorship involves a single individual as the sole owner, responsible for all aspects of the company and entitled to all profits.

- For this reason, it is crucial to take into account the legal and regulatory obligations, as well as the financial requirements and tax ramifications associated with each structure.

Step 3: Choose & Register a Trade Name

An extremely important step in the startup process is to choose and register a name for your company. This procedure can be carried out by the Department of Economic Development, and it is quite easy to achieve.

- First, you need to apply with up to three name options, in order of preference. This is so the DED can check for availability and make sure your options are in accordance with naming guidelines. For this process, you must pay a small fee.

- Additionally, you must present pertinent documents. This generally refers to a copy of the applicant’s passport or Emirates ID and a copy of the lease agreement for the office or warehouse space.

- Finally, the DED will assess that you comply with all of the requirements, and if so, your company’s name will be approved.

Step 4: Submit an Application

To apply for a trade license in Dubai, you must follow the guidelines stated by the pertinent authorities. In this case, the Ministry of Communications and Information Technology (MCIT) and the DED.

The MCIT plays a significant role in the development and regulation of the ICT sector in the country. They watch over cybersecurity and e-government services, promoting digital transformation, telecommunications infrastructure and networks, and overseeing regulation and licensing. For this reason, they are one of the most important governmental institutions in this process, aside from the DED.

- First, you must present the relevant documents. These include passport copies, shareholder agreements, and a no-objection sponsorship letter for foreign shareholders.

- Then is crucial to accurately complete the application form, ensuring that all the necessary information is provided.

- Following that, you need to present the application form and accompanying documents to the DED. This can be done either through online channels or in person, so that they can authenticate the information provided.

- Finally, if your application is accepted, you will be granted the essential licenses and permits to establish a software company in Dubai with all the legal requirements. The approval process usually takes between three days to four weeks.

Step 5: Register for VAT

In order to officially start your software company in Dubai, you must first register it for the Value Added Tax (VAT). You can do this procedure on the Federal Tax Authority (FTA) website.

- First, it is crucial to ensure your company complies with the mandatory registration criteria established by the FTA. If your company meets the requirements, you will need to gather essential documents, including copies of the trade license, shareholder information, and financial statements.

- Once you have everything ready to proceed, you will be required to fill out the online VAT registration form provided by the FTA. Make sure that you provide accurate and detailed information.

- Afterwards, the FTA will assess your application. If you get the approval, your company will receive a Tax Registration Number (TRN).

Step 6: Open a Local Bank Account

The final step to lawfully start your company is to open a bank account. This process is crucial to be able to efficiently manage your finances, receive payments, and streamline salary payments to your employees.

- First, you must choose a local, trustworthy bank in Dubai that suits your company’s goals and needs. This is extremely important to ensure your financial security.

- Once you choose, you must bring all of the pertinent documents. These include: the company’s trade license, memorandum of association, passport copies, and proof of address.

- Then, arrange a meeting with a bank representative to discuss the account opening process. Subsequently, the bank will carefully review the provided documents and evaluate eligibility. After approval, your company will finally have a corporate bank account, facilitating and securing financial transactions.

Conclusion

In conclusion, software companies in Dubai play a crucial role in driving the city’s technological advancement and economic growth. Furthermore, these companies enjoy numerous benefits, including access to a diverse talent pool, a thriving business ecosystem, and endless opportunities for global expansion. In addition, with streamlined procedures and supportive government initiatives, setting up a software company in Dubai is relatively hassle-free.

Without a doubt, starting the best software company in Dubai is an easier process than it might seem. And success is guaranteed with our help!

If you want to learn more about this and other topics, you can go to our insights section now!

FAQs for Start Software Company in Dubai

What are the steps to start a software company in Dubai?

Start a software company in Dubai by selecting your business activity, choosing between mainland or free-zone, reserving a trade name, applying for a licence, setting up an office, and opening a bank account.

Which licence do I need for software development in Dubai?

You’ll need a “Professional Licence” for software development or a “Commercial Licence” if you trade/distribute software.

How much does it cost to open a software company in Dubai?

The cost of starting a software company in Dubai starts from 12,900 Dirhams. The cost can go up to 50,000 Dirhams, depending on various factors

Can I own 100 percent of my software company in the Dubai free zones?

Yes! In many free zones, you can own 100 percent of the company as a foreign investor.

What are the benefits of starting a tech/software company in Dubai?

Benefits include full foreign ownership, zero personal income tax, access to global markets, and modern tech infrastructure.

Which free zones are best for software businesses?

Top choices include Dubai Silicon Oasis, Dubai Internet City, and Meydan Free Zone for tech startups.