As a global business hub, the United Arab Emirates attracts entrepreneurs and investors. The free zone system is one of the most attractive features for foreign businesses. Especially those looking to establish themselves in the UAE. Free zones are designated areas offering special tax and regulatory advantages to companies.

The organizations that are set up within their boundaries. Across the UAE, there are 67 free zones. Each with its unique benefits and regulatory environment. A company set up in a free zone offers a streamlined and efficient path for new businesses.

The guide explores the:

- The key steps involved in setting up a UAE free zone

- The company’s advantages that it offers, and

- How you can make the most of these opportunities in 2025.

- Connect Business Center: Your partner for company setup

What is a Free Zone Company?

An entity established in a designated free zone area in the UAE is termed a free zone company. These zones are designed to attract foreign investment by offering various incentives such as:

- Tax exemptions

- Simplified regulations, and

- Robust infrastructure

Free zone companies are onshore entities operating within the UAE under specific conditions. Unlike offshore companies incorporated outside of their jurisdiction. The UAE boasts several free zones dedicated to various industries. These may involve technology, finance, media, healthcare, and others. Companies operating in a free zone can enjoy benefits such as 100% foreign ownership. They have tax exemptions and full repatriation of profits and capital.

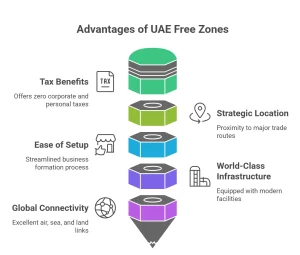

Why Choose a Free Zone Company in the UAE?

Establishing a UAE-free zone company comes with numerous advantages. Digging it out, what are those?

Full Foreign Ownership

100% ownership of the business is one of the most attractive features of free zone companies. In comparison, the mainland companies require a local sponsor or partner. However, free zones offer complete control. This makes it easier for entrepreneurs to manage and grow their businesses.

Tax Benefits

UAE free zones provide lucrative tax benefits for businesses. These include:

- Zero corporate and personal taxes for a specified period (usually 15 to 50 years, depending on the free zone).

- No customs duties on imports and exports within the free zone.

- No restrictions on the repatriation of profits and capital. In turn, ensures that businesses can freely transfer funds abroad.

Strategic Location

UAE free zones are strategically located near major:

- Seaports

- Airports, and

- Logistics hubs

This proximity to global trade routes enhances businesses’ ability. Connecting with international markets and streamlining their operations. Dubai is a central point for trade between Europe, Asia, and Africa.

Ease of Setting Up a Business

Company formation in a UAE-free zone is a straightforward process. Involving minimal bureaucratic hurdles and fast-track approval systems. Allowing entrepreneurs to complete the Dubai Freezone company setup quickly and begin their operations. Also, the UAE government offers online services. This enables entrepreneurs to manage their company setup process with ease.

World-Class Infrastructure

UAE Free zones are equipped with state-of-the-art infrastructure. From high-quality office spaces and warehouses to storage facilities. These zones also offer:

- Modern technology

- Logistics facilities, and

- Business services

Without a doubt, an ideal location for companies across various industries.

Global Connectivity

Due to so many reasons, Dubai’s free zones benefit from the city’s position as an international business hub. The excellent air, sea, and land connectivity helps businesses tap into global markets and supply chains with ease.

How to Choose the Right Free Zone for Your Business?

Right-free zone selection for your free zone company setup in Dubai is crucial. It ensures your long-term success. Consider these factors when choosing the best free zone for your company:

Business Activity

Different free zones cater to specific business sectors. Dubai Media City is ideal for starting a media company. Meanwhile, Dubai Silicon Oasis is focused on technology and innovation. Select a free zone that aligns with your business activity. This way, you can take advantage of facilities, resources, and networks.

Location

Consider the geographic location of the free zone for your:

- Target markets

- Logistics needs and

- Transportation options

Dubai has numerous free zones close to airports and seaports. Proximity to these hubs can be an advantage for companies involved in international trade and logistics.

Cost

Evaluate the business set-up cost in a particular free zone. Costs may vary depending on the infrastructure, type of office space required, and specific benefits offered by the zone. It’s essential to assess both initial setup costs and ongoing operating expenses to ensure it fits your budget.

Regulatory Environment

Ensure that the free zone’s regulatory framework supports your business requirements. Some free zones offer additional benefits, such as simplified visa and licensing procedures, making it easier to manage your operations.

Steps to Set Up a Free Zone Company

Freezone company setup in Dubai involves the following key steps:

Determine the Type of Free Zone Entity

Free zone companies can take different forms. It primarily depends on the business type and the number of shareholders. For instance, some of the most common entity types include:

- Free Zone Limited Liability Company (FZ LLC): Suitable for companies with multiple shareholders.

- Free Zone Establishment (FZE): A single-shareholder company. It is ideal for solo entrepreneurs.

- Branch of a Company: A branch of an existing local or international company. It operates under the same name and business activities.

Choose a Company Name

Your company name must align with the business activity and legal status. It should be unique and comply with UAE naming conventions, which prohibit names that reference religion or violate public morals.

Apply for a Trade License

The trade license type you apply for depends on your business activities, such as:

- Commercial

- Industrial, or

- Service-based operations

Some free zones offer mixed licenses that allow you to conduct multiple activities.

Select Office Space

Choose from various office space options, ranging from flexi-desks (shared workspaces) to fully furnished or custom-built offices. Free zones typically offer flexible office solutions to match your business needs and budget.

Submit Required Documents

Provide the necessary documents for company registration, including:

- Passport copies of shareholders and directors

- Proof of address

- Business plan

- Bank reference letters

- Articles of incorporation and other corporate documents

Open a Bank Account

Open a corporate bank account in the UAE to manage business finances once the company is registered and the trade license is issued.

Apply for Employee Visas

If you plan to hire employees, you can apply for work visas and labor cards for your staff through the free zone authorities.

Start Operations

Once all approvals are in place, you can start business operations and tap into local and international markets.

Connect Business Center: A Partner to Your Company Setup

Connect Business Center is your ultimate way to UAE free zone company setup. The experts have all the knowledge and resources required to set up your business. With years of experience in delivering exceptional services, Connect Business Center proudly announces its support from start to end. Don’t worry about documentation as we’ll handle everything on your behalf. Sit back and relax while we do the job! The professional team makes each step smoother. Let us give you a chance to fix your business worries. Hire us today and discover how we can help!

Conclusion

In conclusion, a business formation in a UAE-free zone offers numerous advantages. The companies enjoy 100% foreign ownership, zero taxes, and a strategic location for international trade. Free zones are an attractive option for entrepreneurs. Those who are seeking to expand their operations in the UAE. The registration process is straightforward, offering world-class infrastructure and access to a global business network.

Businesses can maximize their potential in the UAE’s economy. They can do so by selecting the right free zone and understanding its unique benefits. But before jumping, you must follow the setup process closely.

Seeking to obtain expert assistance to understand the free zone company setup process? Connect Business Center is here to provide tailored solutions. We will guide you every step of the way. Connect with us today and let us help you set up your business in a UAE-free zone. Unlock the many opportunities available to entrepreneurs!