The UAE attracts business owners internationally when thinking about opening an international business. When considering setting up an offshore company in Dubai UAE, about the features of the company is a crucial step since this will affect the functions of your business.

In this article, we will be explaining the benefits that setting up an offshore company can bring to business owners. Enhancing the understanding of factors and features of the different types of companies offered to you in the UAE.

What is offshore company in the UAE

In summary, UAE offshore company is a business meant to operate outside of the UAE territory. These companies share a lot of benefits with a freezone business, yet it is important to note that a Dubai offshore company cannot replace it.

One of the biggest benefits for investors is the tax flexibility that comes with establishing a business in Dubai. The addition of the lack or reduction of taxes with the geographical position creates a spot for businesses with international goals.

- The most important difference between an offshore and an onshore company is that an offshore company in the UAE cannot execute any trading activities in the UAE. Nonetheless, these companies can conduct business with other countries.

- Some of the most common types of Offshore companies tend to be Online advertising companies, Distribution and logistics firms, and more.

- Limited liability companies (LLCs), limited companies, and limited partnerships can all be permissible business structures for establishing Dubai offshore companies

Benefits of Establishing an Offshore Company in UAE

While the UAE continues to grow its economy and push for legislation that fosters a favorable investment environment, more investors and business owners are drawn to the United Arab Emirates in various ways.

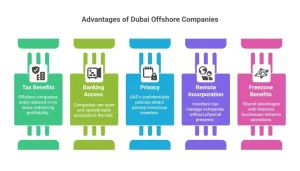

Consequently, an offshore company in Dubai is frequently set up in response to the attractive features the UAE government puts in place to incentivize business in its territory. Some of these benefits of setting up a Dubai offshore company are:

- Tax benefits: Offshore companies in Dubai are rewarded by several tax benefits that positively impact the business running cost as well as the profits they create.

- UAE bank account: Offshore companies are also allowed to open and operate as needed bank accounts in the UAE banks.

- Privacy: The UAE confidentiality policies also attract business owners and investors.

- Remote Incorporation: These companies do not require the investor to be physically present in the UAE to hold its position of director or shareholder.

- Freezone benefits: Although an Offshore company in Dubai cannot replace setting up a freezone business, they do get to share multiple benefits in their location.

Choosing a Location and Setup Offshore Company in Dubai

Offshore companies in Dubai have to be set up outside of the mainland, which frequently ends up taking the business to free zones available in the UAE.

- Currently, three principal jurisdictions are offering Offshore companies in the UAE. These are: Ras Al Khaimah (RAK), Ajman Free Zone, and the Jebel Ali Free Zone (JAFZA).

- Even when Offshore companies do get shared benefits from being established in a Freezone it also means some restrictions of said zones are also applied.

A. Free Zones vs. Mainland: Pros and Cons

In the UAE there are two main ways to set up a company: a mainland business or a freezone business. Multiple factors differentiate these two.

- A mainland company is characterized by being an onshore business in the mainland with no restrictions on its commercial activities.

- Freezone businesses are known for being located in the UAE free zones. These businesses are restricted to commercial activities within their zone.

The location of the business in the UAE will decisively impact its final cost as well as its ability to carry out its operations effectively.

B. Selecting an Office Space

At Connect Business Center we offer our clients a wide range of offices spaces, both physical and virtual, that adapt to the needs of your business and the budget set.

- With thousands of listings available, we are able to tailor the search for your space up to your needs.

- Our spaces come with all the amenities you need to get your business going in no time.

- The space of your office will vary according to your business license and activities.

- Offshore companies enjoy the benefit of having no requirement for a physical office.

- Most importantly, take into consideration that Offshore businesses are not able to acquire a physical office in the UAE.

C. Virtual Office Solutions

In Connect Business Center we work firstly on adapting to the needs of businesses with a wide range of virtual spaces.

- Our virtual office packages include a prestigious business address, mail handling, call answering services, and access to a variety of business amenities.

- We offer you a virtual space that provides you with a legitimate business address in desirable locations.

- We grant a dedicated telephone line in addition to a personalized answering service.

- Order office supplies such as stationery and business cards.

- In addition to favorable discounts, to will be able to book meetings in convenient locations with us.

Steps to start an offshore company in Dubai, UAE

Starting an offshore company in Dubai is a relatively quick, affordable, and easy process that brings you multiple benefits. Some important factors to take into account in the process of starting a business are:

- Dubai offshore companies have a minimum requirement for the number of company directors and company shareholders; these individuals can be of any nationality.

- Importantly, a Dubai offshore company cannot rent local premises in the UAE, employ staff, and secure residence or work visa for its employees

- You are not allowed to conduct business within the UAE if your company is offshore. Businesses with the goal of commercial activity in the UAE will need another model.

- Offshore company owners are also not eligible for UAE residency visas.

- An offshore company in the UAE is not eligible for a business license or trade license (unlike an onshore company).

Choose your company name

Business names must align with their activities, and the trade name required by the UAE government should be followed.

- The name must include the “Limited” or “Ltd” to signify its legal identity as an offshore entity.

- Another company cannot have registered the name. However, you can use the name of a company that has been closed down for at least one year.

- Companies’ names cannot contain offensive language or words considered indecent.

- A company name cannot use God’s name or any reference to religious organizations.

Fill in your application form

During the process of setting up your offshore business application, you will need to submit an application form. Individual shareholders will need to organize the following documents:

- Business plan

- Copies of all shareholders’ passports

- Bank statements

- Proof of residence.

- Three options for your business name

- In addition to the Suggested Activities of the Offshore Company

Once granted, every document you will have to submit your application. With this, you should pay the required fee, and then you should receive an incorporation certificate. Some things to have in mind while preparing to start your company:

- To establish an offshore company in Dubai, one shareholder and one secretary are required as a minimum.

- An offshore business has no minimum capital limit.

Draft MOA and AOA

The drafting of your MOA and AOA is a step that cannot be skipped in the setup of your Offshore company. Dubai requires these documents to be the root of multiple companies and will dictate the business development.

- MOA stands for memorandum of association, and AOA for Articles of Association. These documents are crucial for the legal registration of an offshore company business in Dubai and the United Arab Emirates.

- Importantly, failure to provide the memorandum of association of your company could result in serious consequences such as fines.

- The Articles of Association (AOA) of an offshore company in Dubai states the way in which an organization will pay dividends, issue stock shares, audit financial records, and exercise voting rights.

- Memorandum of Association (MOA) for an offshore company Dubai is a key Document that contains all the basic information about the company. This includes the company’s objectives and activities.

- By itself, an AOA is more detailed in comparison to the MOA of a company. It has a set of rules for the administration of the company, and officers and management.

Lastly, experienced guidance helps organize and ensures the effectiveness of both documents, drafted under highly specific parameters, each with its own documentation.

Open your offshore bank account

Dubai and the UAE offer foreign owners of offshore companies the ability to open bank accounts for their business. Moreover, a UAE bank account offers you benefits like:

- Strict Bank secrecy

- Highest security standards

- Account currency is optionally in EUR, USD, GBP, CHF, YEN, and AED credit score

- In addition to more benefits.

Following the process of opening your UAE offshore account, you will need to keep in mind the following:

- Getting guidance throughout this process will make sure you go through it faster and straightforwardly.

- Dubai Offshore offers support around the process of opening a bank offshore account.

Cost of Offshore Company Setup in Dubai

The cost of forming an offshore company in Dubai depends on jurisdiction and business type.

| Item | Estimated Cost (AED) |

|---|---|

| Government Registration Fee | 7,000 – 10,000 |

| Documentation & Certification | 1,500 – 3,000 |

| Professional & Service Fee | 3,000 – 5,000 |

| Annual Renewal | 3,000 – 5,000 |

Total Estimated Setup Cost: AED 10,000 – 15,000

(Prices vary slightly between RAK, Ajman, and JAFZA offshore jurisdictions.)

Conclusion

The United Arab Emirates has global attention from business owners and investors thanks to its legislations that incentivize business within its economy. An Offshore company in Dubai consists of a company whose main purpose is commercial activities outside of the UAE.

Finally, the process to set up an offshore company in the UAE is relatively quick, and with the correct guidance. Offshore businesses are not allowed to own a physical office. However, Connect Business Center offers you a wide range of virtual spaces equipped with everything you need.

Do you want to learn more about the business environment in Dubai? Check our blogs section!

FAQs About Offshore Companies in Dubai

Q1. Can an offshore company conduct business within the UAE?

No. Offshore companies can only operate outside the UAE or with non-UAE clients.

Q2. Can I get a UAE residency visa through an offshore company?

No, offshore entities do not qualify for visas. Consider a Free Zone company for visa eligibility.

Q3. How long does it take to register an offshore company?

Typically, 3–5 business days if all documents are correctly submitted.

Q4. Can an offshore company open a UAE bank account?

Yes. Most UAE banks allow offshore companies to open corporate accounts, subject to compliance checks.

Q5. Which offshore jurisdiction is best in the UAE?

RAK ICC and JAFZA are preferred for credibility, tax benefits, and flexible setup.