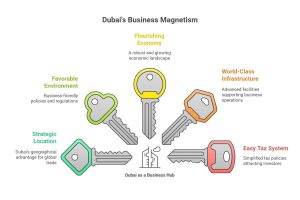

Undoubtedly, Dubai has become one of the most preferred business hubs in the world. Thanks to the UAE’s strategic location, favorable business environment, flourishing economy, world-class infrastructure, and easy tax system, it is easy to start a business in Dubai as a foreigner and set up a company. Investors have an endless list of benefits. Indeed, there are some restrictions for foreigners, but the benefits are even more powerful.

In this article, you will learn everything you need to know about starting a business as a foreigner in Dubai. Let us see:

1. Why is Dubai the business mecca?

2. Why is doing business in Dubai attractive?

3. What are the benefits of starting a business as a foreigner in Dubai?

4. Steps you must follow to start your business in Dubai

5. What are the things foreigners need to know before starting a business in Dubai?

6. How can Connect Business Center help you to start a business as a foreigner in Dubai?

Why is Dubai the business mecca?

The path that the Emirate of Dubai has traveled to become one of the largest shopping centers in the world has not been easy. Although today Dubai is the largest and most populous city in the United Arab Emirates, its origins go back to being a humble fishing village in the 18th century. From there, it slowly started to take off as a trading port for different shipping companies looking to do as much business as possible.

With the local government embarking on a mission to make their city the new hotspot for industries of all kinds to flourish, nothing is stopping them from rising to the top. With top-of-the-line economic and business reforms and policies to attract as many global businesses and capital to your side of the world, Dubai has become the place to be if you want to grow your business.

Why is doing business in Dubai attractive?

The number of reasons that have made Dubai the best option for companies from all over the world to flock to this city and establish their offices and stalls is undoubtedly attractive. It is the connection between the East and the West. Dubai has become an international business hub. A city that hosts summits, conference rooms, and exhibitions that bring together business leaders from around the world.

One of the most important reasons to establish a business in Dubai is the fact that there is a free economy policy, which means that the involvement of government regulations and policies is minimal, and taxes to operate are basically non-existent.

In addition, the inexhaustible mission of being able to offer the best working conditions for companies that enter into either facilities or technological advances.

Some well-established international companies and brands are also expanding here. Within Dubai, there are so-called Free Zones, in which entities can be established that offer competitive advantages to foreign investors, with the DMCC being the main free zone.

What is the DMCC?

Dubai Multi Commodities Center – DMCC is a government entity established in 2002 in the United Arab Emirates (Dubai) as a leading center for international commodity trade and is the fastest-growing Free Zone in the world.

Establishing an entity within the DMCC free zone offers numerous business and competitive advantages across a wide range of business activities and multiple business sectors, with a secure and regulated business environment. We listed some of the benefits of having your own company within the DMCC below:

- 100% ownership of the company

- Complete capital repatriation

- Zero percent of corporate and personal income tax

- Efficient immigration services, including visa issuance and support

- Events, segment-specific clubs, and educational workshops

- Updates in education regarding the latest developments in regulations and compliance standards

To summarize, you will not have to worry about finding an average workspace and fighting for internet connection speed. Dubai’s strategic position as a gateway between the economies of the East and West also makes it the perfect place to develop global trade relations regularly.

What are the benefits of starting a business as a foreigner in Dubai?

It is a land where opportunities to succeed abound. Entrepreneurs and businesses can be part of an ever-evolving ecosystem in one of the world’s most forward-thinking cities. Next, we will see some of the benefits as a foreigner in Dubai:

- No corporate tax, all annual accounting, and exemption from tax obligations

- Register the Freezone Company without knowing the names and details of the shareholders and directors for public records

- Register a Freezone Company with 100% Foreign Ownership

- Over 80 countries signed and negotiated a Double Taxation Avoidance Agreement with the UAE

- Banking regulation and multiple currencies support

We can guide and support you to register your Freezone Company in many special zones, with benefits applicable only for foreign businesses in the UAE, such as the Dubai Free Zone (DMCC).

Steps you must follow to start your business in Dubai

Before embarking on this process, you must know the steps you need to follow in order to start a business in Dubai and reach your goals effectively.

Business plan

Remember that setting up a business in a new country is a complicated task. Hence, it would be helpful to have a plan and preparation before forming your company.

Get a Visa

Next, you have to get your visa in Dubai. Entrepreneurs who have set up a business of their own at some point of time in their career are eligible for a long-term visa. In case you want to obtain a business Visa, here are some requirements:

- Provide evidence of your experience as an entrepreneur

- You must have been a majority shareholder of a start-up

- Relocating to the UAE has the will to legally establish a business in one of the seven emirates.

- Provide a convincing business idea or a business plan that you wish to bring to life in the UAE.

Finally, you must successfully pass the requirements of the Federal Authority for Identity, Citizenship, Customs & Ports Security, including a background check and health assessment. However, an incubator supported by the UAE government must approve your application.

Get a license

It is an essential document for all businesses in Dubai. You get your license from the Department of Economic Development (DED). However, we can help you with this process.

License types for businesses

The three main license types are trade license, industrial license, and professional license.

The trade license allows you to trade, import, and export products throughout the UAE. As a result, this type of license is very common in Dubai.

Industrial licenses approve the industrial project to carry out its activity. The person uses this license throughout its validity period to start operation and production.

The professional license allows foreigners the advantages of a sole proprietorship, permitting them 100% ownership. However, keep in mind that it is mandatory to appoint a UAE national as a local service agent to complete the judicial formalities.

Documents required to set up a business

There are several documents you need to provide, such as a business plan, an application form, colored copies of passports from the shareholders, two years of audited financial reports for a corporate entity, and a specimen signature of the company’s shareholder.

The UAE government has many initiatives for foreigners in Dubai who want to start setting up their businesses.

Business set up

The first thing you must do is determine your business entity. This will help you choose your type of business license. Then, you have to give your business identity by giving it a name, which will reflect its nature.

The next step is to find a local partner or sponsor. However, partners hold 51% of your company’s shares. The rest will be distributed among you and other shareholders. In addition, you need to get the initial approval of your documents from the concerned departments.

Another thing you should do is draft your memorandum of association. This document states the additional activities of the company. Finally, complete your business registration at the Dubai Chamber of Commerce and Industry. Keep in mind that there may be additional steps to accomplish, depending on your business type.

What are the things foreigners need to know before starting a business in Dubai?

We mentioned the benefits of setting up your business as a foreigner in Dubai. Nevertheless, there are some obstructions to doing business as a foreigner.

Communication style

The types of communication vary around the world, from country to country and area. For companies that work outside of their home country, this can be difficult. Keep in mind that organizations doing business in the UAE need to be aware of some of the cultural gaps they may encounter, which may vary significantly from their own cultures. In the United Arab Emirates, the level of formality and candor can also be difficult to adapt to.

Islam

Even though it is a progressively modern state, religion remains at the center of Emirati culture and society. Islam plays a vital role in people’s daily lives, both inside and outside the workplace. It is vital to observe Islamic customs and appreciate the impact of the Islamic religion on business dealings when doing business in the UAE.

Time

Timing is viewed with a much more casual mindset compared to other countries. Meetings, for example, are often overcrowded, start late, or are postponed at the last minute without notice. Another important difference in the business culture of the United Arab Emirates is that the working week is different from that of Christian countries, from Saturday to Wednesday.

Hierarchy

Hierarchy remains a very important principle to keep in mind when doing business in the UAE. At the same time, respect for titles and the role of individuals within society is important. Many organizations have a top-down hierarchy, with a central executive making most decisions.

The United Arab Emirates is becoming increasingly modern, but conservative Muslim traditions seem to be at the core of Emirati society. For this reason, there are business organizations that recognize the contrast between the new and the traditional.

Participating in an intercultural business program like the one offered by Connect Business Center will help you develop strategies to operate successfully in the UAE, thereby improving the effectiveness of your business.

Language

Although English is widely used in meetings and business transactions in the UAE, all employment records, including contracts and other documents, such as instructions sent to employees, must be in Arabic.

Adherence to culture

The local culture is linked to Islamic traditions. Business communication follows a very formal approach, and courtesy is highly appreciated.

How can Connect Business Center help you to start a business as a foreigner in Dubai?

Connect Business Center offers a one-stop shop for all your Emirates fulfillment needs. From the recommendation of the type of entity and the most suitable jurisdictions for its establishment, to continuous management accounting and business formation service.

Would you like to contact Connect Business Center to obtain more information about starting a business as a foreigner in Dubai? If you have any questions, send us an email to [email protected], and you will talk to one of our representatives, who will answer your questions.

Also, if you would like to send your resume or CV, you can enter thetalentpoint.com. Resumes sent to [email protected] will not be stored. Do not hesitate to contact us now.

FAQs

Can foreigners own 100% of a business in Dubai?

Yes. Most business activities allow full foreign ownership.

What are the steps to start a business as a foreign investor?

Choose an activity, pick a jurisdiction, submit documents, license issuance, and visa processing.

What documents do expatriates need for company formation?

Passport copies, business plan, and application forms.

Do foreigners need a local sponsor?

Not for most activities today.

How much investment is required?

Investment depends on the license type and business model.

Are residency visas included with company formation?

Licenses often include eligibility for investor or partner visas.