The UAE is famous for its business-friendly environment, attracting entrepreneurs from around the world every year. The vital component contributing to its attractiveness is the tax structure. The introduction of VAT in 2018 means understanding tax compliance is more critical than ever. Many businesses seek the expertise of Tax consulting services in UAE, which greatly assist them in navigating the complexities of the tax landscape in the Emirates.

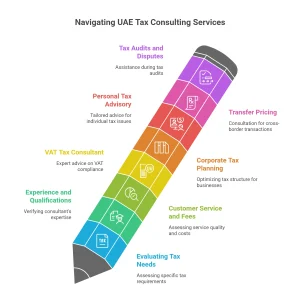

Therefore, choosing the right tax consulting services can greatly impact your financial health. In turn, this ensures compliance and optimizes your tax position. This blog explores expert tips on how to choose the best tax consulting services in the UAE to suit your specific needs. We are going to cover details, such as:

- Evaluating tax needs (VAT, corporate)

- Checking out relevant experience and qualifications

- Assessing their customer service and fees

- Connect Business Center, the ultimate tax consulting solution

Understand Your Tax Needs

Know the tax requirements before reaching out to a tax consultant. An individual needing personal tax advice or a company that requires tax compliance and optimization services. Everyone should have analyzed their requirement beforehand

For instance, the UAE tax landscape offers various types of tax consulting services in UAE, including:

VAT Tax Consultant in UAE:

If your business is VAT-registered, you may need expert advice on:

- VAT filing

- Registration, and

- Compliance.

Corporate Tax Planning:

Businesses optimize their tax structure and ensure compliance with UAE tax regulations.

Personal Tax Advisory:

Tailored advice for individuals on tax issues. The problems concerning residency, assets, and global tax obligations.

Transfer Pricing:

Consultation for companies involved in cross-border transactions. This helps ensure compliance with international tax standards.

Tax Audits and Disputes:

Taking assistance in case of tax audits or disputes with the UAE Federal Tax Authority (FTA).

Relevant Experience and Expertise

Experience is key when selecting a tax consultant in the UAE. The consultant should have years of experience in the region’s tax system. Having an in-depth understanding of local and international tax regulations is a plus

Why experience matters:

Up-to-date Knowledge:

In the UAE, tax regulations can change rapidly, especially with the introduction of VAT and ongoing updates to other taxes. However, an income tax consultant with up-to-date knowledge will help ensure your compliance with the latest tax laws.

Industry-Specific Expertise:

Different industries may have unique tax implications. A tax consultant experienced in your industry will address the specific nuances that may impact your tax obligations.

Proven Track Record:

Look for testimonials, case studies, or references. These demonstrate the firm’s ability to navigate the UAE tax landscape for businesses.

Professional Qualifications and Credentials

Verify that the tax consultant holds the appropriate professional qualifications. Tax consultants in UAE have certifications such as:

- Chartered Accountant (CA)

- Certified Tax Advisor (CTA)

- Certified Public Accountant (CPA)

- Member of the UAE Chartered Institute of Taxation

Evaluate Their Reputation and Client Feedback

Examining reputation is one of the most effective ways to evaluate a tax consultant. Word-of-mouth and online reviews can provide valuable insights. A better way to analyze the consultant’s level of service and reliability.

The following considerations must be taken when evaluating a consultant’s reputation:

Client Testimonials:

Check out case studies and testimonials of businesses similar to yours. Get a clearer idea of the consultant’s capabilities and success stories.

Online Reviews:

Check trusted online platforms like Google, LinkedIn, or specialized tax forums for feedback from clients.

Word of Mouth:

Ask fellow business owners or professionals in your network for recommendations. Personal referrals can often lead to finding reliable and trustworthy consultants.

Assess Their Communication and Customer Service

The ability to communicate effectively is crucial. Especially when working with tax consulting services in the UAE. Hire a professional who understands your tax needs, but they can also clearly explain complex concepts.

Ask yourself the following questions:

- Do they explain things clearly? When you ask questions, do they provide easy-to-understand answers, or do you feel more confused afterward?

- Are they proactive in communication? A good consultant should anticipate your tax needs and proactively offer advice, rather than just react when you ask for help.

- Do they offer support when needed? Taxes are not a one-time issue but an ongoing matter. Ensure that the consultant offers consistent support throughout the year.

A good consultant will build a strong working relationship with you. Guaranteeing that your tax strategy aligns with your business goals.

Evaluate Their Fees and Value for Money

Cost should not be the sole deciding factor when selecting a tax consultant. But it’s essential to know their fee structure. The best tax consultants offer a balance between quality service and competitive pricing.

Ask consultants for a breakdown of their fees and their service offerings. The pricing structure must be transparent. So that you are not faced with hidden costs later on.

Consider the value you will receive from their services. A more expensive consultant may offer a premium service. The cheaper option may still provide great value. Especially if they are efficient and knowledgeable.

Approach to Tax Planning and Strategy

A good tax consultant should help you comply with taxes. But also work with you to optimize your tax strategy.

However, some key aspects to consider when evaluating a consultant’s approach:

- Tax Savings: Are they focused on helping you minimize taxes legally and ethically?

- Long-Term Planning: Do they offer strategies to optimize your tax position over the long term?

- Risk Mitigation: Are they helping you navigate potential risks, such as avoiding penalties for late filings or mistakes?

The right consultant should align with your goals and help you build a tax-efficient strategy that supports your business growth.

Compatibility and Trust

Work with a consultant who understands your business culture and values. For this, trust and compatibility are critical. Relying on their expertise to handle sensitive financial matters requires trusting someone first.

You can arrange and meet with potential consultants. Assess whether you feel comfortable with their approach and demeanor. Trust your instincts and choose a consultant you can rely on. It’s a matter of getting strategic advice and ongoing support.

Connect Business Center: Your Ultimate Tax Consulting Company UAE

The right tax consulting services in UAE selection is a critical decision for individuals and businesses alike. The right consultant can help you navigate the complex tax system. As a result, it ensures compliance and optimizes your tax position. Ultimately, it helps you save time and money.

When making the right choice, Connect Business Center is at the top of the list. We provide expert tips accordingly by understanding your needs. You can verify our years of experience and credentials serving a large clientele. Our market reputation says all about us. The pricing and approach we offer are what make us stand apart from others.

Make an informed decision that will benefit your financial situation. Let’s contribute to the long-term success of your UAE business. Don’t hesitate to take the time to select a tax consultant who truly understands your needs. We at Connect Business Center are the right partnership for you! A key to a prosperous and tax-efficient future in the UAE.