Getting a tax clearance certificate UAE shows that a company or an individual is up to date with their tax obligations.

We write this article for those involved in various business dealings. Acting as a mark of compliance with the country’s tax laws. The UAE continues to develop its economic landscape. This will result in businesses and individuals being eager to know how to get this certificate.

In this article, we give a detailed look at the eligibility criteria, strategic importance, and application process of a Tax Clearance Certificate UAE.

We will give you the steps and expert advice to help to choose Tax Consulting Services in UAE, whether you’re an entrepreneur, a tax professional, or just aiming to keep your financial records clean.

What is a tax clearance certificate?

A Tax Clearance Certificate (TCC) is an official document issued by the UAE Federal Tax Authority confirming that a person or business has no outstanding tax liabilities.

In other words, it’s proof that your tax records are clean and that you’ve met all VAT and corporate tax obligations.

Types of Tax-Related Certificates in the UAE

It’s important to differentiate between the various types of tax certificates available:

- Tax Clearance Certificate (TCC): Confirms all taxes are cleared — used for VAT deregistration, business closure, or ownership transfers.

- Tax Residency Certificate (TRC): Proves residency status for double taxation treaty benefits.

- Commercial Activity Certificate (CAC): Certifies that a company is actively operating within the UAE.

Importance of a Tax Clearance Certificate UAE

A tax Clearance Certificate in the UAE is a symbol of compliance that helps entities avoid penalties associated with non-compliance. This also aids in maintaining their reputation as law-abiding entities. Particularly, you’ll find this certificate indispensable when a business is being acquired. Especially during a company’s winding up, or when a business needs to deregister from VAT due to a decrease in sales below certain thresholds.

You will need a TCC in the following cases:

-

When deregistering VAT with the FTA.

-

During a company liquidation or business closure.

-

When transferring business ownership or shares.

-

To apply for or renew investor/residency visas tied to business activities.

-

When selling commercial property or exiting the UAE as an entrepreneur.

-

For banking, auditing, and financing purposes.

Application Process for Tax Clearance Certificate UAE

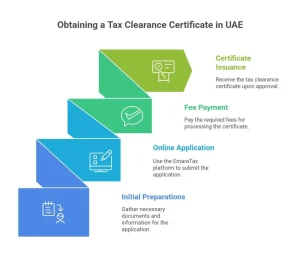

Here we share the detailed application process to apply for a tax clearance certificate UAE:

Initial Preparations

The first step in the process for obtaining a certificate is to access the EmaraTax platform. Log in with your credentials or UAE Pass. Then, navigate to the ‘Other Services’ section and click on the ‘Clearance Certificate’ option. You can begin a ‘New Request’ and fill out the application form with your business details. This includes trade license information in English and Arabic and specifies the reason for the certificate request. You may include changes in ownership or business closure.

Now, upload the necessary documents. It may include financial statements and a declaration letter. Some additional documents, like a sale contract or proof of business cessation, may be required. You need to ensure all financial figures are presented in AED. On completion and review of the application, now submit your request and a filled-in declaration form.

Online Application Procedures

You can apply for an application online by using the Emara Tax platform. This platform offers a user-friendly online system for submitting applications. This eliminates the need for paper-based submissions. Facilitating a smooth application process while ensuring you have digital copies of all required documents.

How to Register and Log In

This is the very first step. Visit the Emara Tax portal and register. To log in, use the same portal by using your credentials

Navigating the Portal

After logging in to the portal, go to the ‘Tax clearance certificate’ section. Complete the application form with the required elements, such as your TRN, business details, and contact information.

How to Submit the Application

Upload the necessary documents, including your passport copy, trade license, and bank statements. Check your application and present it for processing.

Applicable Fees and Payment Methods

The payment for obtaining a certificate depends on the type and tax status. For instance, a TRC incurs a submission fee with additional charges based on whether you are a tax registrant or not. It also incurs fees based on an individual or a legal entity.

An extra fee applies for each printed certificate if requested. Confirm the current rates before applying, as they are subject to change.

Eligibility Criteria for Obtaining a Tax Clearance Certificate UAE

The eligibility criteria for obtaining a tax clearance certificate UAE have been discussed in detail:

Individual Applicant Requirements

UAE residents need to reside in the UAE for a minimum of 183 days within the financial year of application. This is for individuals aiming to obtain a TRC. This residency requirement is pivotal for determining eligibility. Foreign and offshore company branches are not considered residents and thus are ineligible for a TRC.

Corporate Entity Requirements

Before applying for a TRC, legal entities must have been established in the UAE for over one year. Ensuring a significant presence there. These entities seeking a CAC must be VAT-registered in the UAE, as the CAC serves to verify their commercial activities within the nation.

Special Considerations for Non-Residents

Foreigners and non-residents must provide substantial proof of their stay and economic ties to the UAE to qualify for tax certificates. It includes documentation of physical presence and financial interests. On the other hand, non-residents must carefully document their stays and financial activities to satisfy the FTA’s stringent criteria.

Documentation Needed for Initial Assessment

- For a TRC, individuals must submit their passport, residence permit, Emirates ID, residential lease agreement, income proof, bank statements, entry and exit report, and evidence of permanent residence in the UAE.

- Legal entities are required to provide their trade license, memorandum of association, authorization proof, audited financial statements, and bank statements. Government entities should submit a copy of the decree or government decision, trade license, and a request letter from the entity.

- Applicants need to submit a trade license and a request letter for a CAC. The required documents for a TRC may differ based on the applicant’s duration of stay in the UAE and other considerations.

- Applications can be made through the EMARATAX portal, which operates around the clock for TRCs and CACs issuance. The submission process is streamlined, with an average submission duration of 45 minutes and a processing time of 5 business days upon receiving a complete application. The TRC is valid for one year from the chosen financial year’s commencement, and the CAC is valid for one year from the selected date.

- A submission fee of $13.60 (AED 50) is applicable for treaty purposes, with additional fees contingent on the applicant’s status. The CAC incurs a fee of $136 (AED 500), and an extra $68 (AED 250) per copy is charged for a physical copy of the certificate. Certificates are sent digitally to the applicant’s email after payment. If a printed certificate is requested, it is only available for delivery within the UAE. Special forms for the TRC can be submitted electronically or via mail, or by courier for FTA attestation. The necessary Exit & Entry report can be obtained through the UAEICP application.

Conclusion

It is a straightforward process to obtain a Tax Clearance Certificate UAE. If you follow the steps outlined in this guide, you can ensure that all your tax filings are up to date. Gathering the necessary documents while completing your UAE tax certificate application will help you avoid common mistakes.

For instance, if you are closing a business, selling property, or relocating, having this certificate demonstrates your compliance with UAE tax laws. In other words, provides peace of mind.

Additionally, by following this comprehensive UAE tax clearance guide, you can handle the procedure with confidence. Ensuring that your tax matters are settled. If you need further assistance. Seeking help from Connect Business Centers can make the process even smoother.

FAQs on Tax Clearance Certificate UAE

What is the difference between TCC and TRC in UAE?

TCC confirms you have no pending taxes, while TRC is used to prove UAE residency for double taxation benefits.

Can I apply for a Tax Clearance Certificate online?

Yes. You can apply via the EmaraTax portal using your UAE Pass or FTA account.

How long does it take to get the certificate?

The FTA usually issues it within 5 working days, provided all details are correct.

Is a TCC mandatory for VAT deregistration?

Yes. Businesses must obtain a Tax Clearance Certificate before FTA approves VAT deregistration.

How much does it cost?

AED 500 for the certificate and AED 250 for each printed copy.

Can Connect Business Center help with this process?

Absolutely! We specialize in FTA coordination, VAT deregistration, and tax compliance to ensure smooth certificate approval.