Opening a bank account for non-residents in UAE is a somewhat complex process for beginners. Due to the UAE’s status as one of the largest financial centers and an expatriate community, and with the increasing demand for banking services for non-residents, it is a common occurrence these days.

In this article, we will go through the different steps to set up your non-resident account in UAE. We will also inform you about the process, the requirements for a non-resident account UAE, and the terms of eligibility, among other very important aspects that you should take into account when opening a bank account non resident.

Types of Bank Accounts Available for Non-Residents

In the United Arab Emirates, there are a variety of bank accounts for non-residents that you can open. But you must know what they are and the differences between each one, as they can help you with different purposes.

Current Accounts

When it comes to bank account non-resident options, checking accounts are one of the most versatile. In addition to being used as a checking account, it will give you several features and benefits when you use it.

Features of a current bank account for non resident in UAE

Frequent transactions

Checking accounts are designed to allow you to make regular transactions, such as bill payments, transfers, or withdrawals at banks. In addition, you can write checks and make purchases in the country.

Banking services

UAE banks usually give a wide range of services in their banks are additional. These are online banking services, transfers to other countries, and services for managing your money.

Ease of use and zero interest

Current accounts are an easy and quick-to-use type of account. Having the simplicity of using it for your daily transactions. In addition, this type of account does not generate interest on the deposited balances. But it will give you immediate access to your money, which is convenient for you to have money in the short term.

Savings Accounts

In addition, you have savings accounts, which are a totally good option for non resident account UAE. It will give you the option to safely save your money and earn interest on it. This type of account is used by people to have a long-term financial goal.

Features of the non-resident bank account savings

Interest on your balance

The biggest advantage of your bank accounts for non-resident savings is that they will earn interest on the balance you leave in them. Rates may vary depending on the bank you choose and the time in the market.

Access to your money

In addition, you will have easy access to your deposited money. You will be able to make payments, cash withdrawals, and more. But you must keep in mind that to make large withdrawals, you will have to notify us, as these accounts impose a certain limit.

Security

Savings accounts are usually a lifesaver for people, helping them in market fluctuations. These are usually safeguarded by the government or some sort of regulator.

Varied options

In the bank account for non-residents in UAE you will find several options for your savings account, which may include accounts with different rates, minimum balance requirements, and a few other features. These can include debit cards and web banking.

Investment Accounts

Finally, you have investment bank accounts for non-residents, which are used as a strategic option for non-residents of the UAE. These will offer you a platform with various investment opportunities. From bonds, mutual funds, stocks, and others, to generate a medium-term return.

Its specific features are

Diversity in portfolios

This type of account allows you to diversify your financial portfolio. It will distribute your funds among a variety of assets and asset classes to reduce risk and maximize profit potential.

Imminent growth

Also, you can obtain greater growth potential through participation in financial markets. Not forgetting that there is also risk involved.

Flexibility and control in your account

This account allows you to make investment decisions, which allows you to adapt your strategies according to your criteria. You will be able to buy and sell your assets whenever you want and adjust your portfolio in response to the changing market.

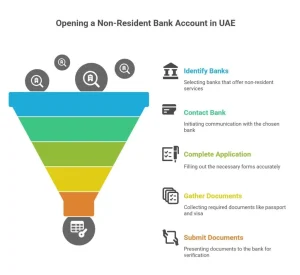

Steps to Open a Bank Account for Non-Residents in UAE

Opening a bank account for non-residents in UAE is a process that requires you to follow a series of steps. This is to make the process of opening a bank account for non-residents in UAE faster and better.

So, we will examine the key steps you should follow, giving you every indication of the procedures and considerations you should keep in mind all along the way. We will also take into account that opening a bank account for non-residents in UAE will allow you to establish yourself in the country financially.

Researching Bank Requirements

First of all, to open your bank account for non-residents in UAE it is of utmost importance that you do some research on the specific requirements of all the banks you want to access. Each one will have slightly different policies, so researching will be your best ally.

Identify the banks

First of all, you should find out which banks catch your attention and which ones offer bank account services for non residents in UAE.

Travel on the websites

Also, several banks have information about their policies on their website, including their requirements. Also, exploring this will help you determine which services are offered by them.

Check with the bank

You can also opt to call the bank or go directly to their branch to speak to a competent person. They will be able to give you more detailed information about the bank’s guidelines and requirements for opening an account.

Consult with professionals

In addition, you can consult with some professionals in the field of finance. They will give you an orientation about each bank, and their requirements and will help you to see the best option according to your criteria and needs.

Initiating the Application Process

After you know which bank you want to apply to, what you should do next is to start the application process for a bank account for non-residents in UAE. This will involve a series of specific steps to apply, following the bank’s policies and procedures.

Contact the bank of your choice

You will need to contact the bank you have chosen to open your account. You can do this by phone, by sending an online mail, or in person. This is to start the opening process.

Request the bank account for non-residents in UAE form and complete the application form

You will then need to request the application form for your bank account for non-residents in UAE. You will need to fill in all the required fields with reliable personal information.

Have all your documentation

Along with your application, you will always be asked for documentation about yourself. This could include a valid passport, proof of address, bank references, and your financial statement. The bank may also require additional documentation depending on its criteria.

Submission of Required Documents

Once you have gathered all your documentation and your application, you must now take the selected documents to the bank of your choice. This step is important for the fast progress of your bank account for non-residents in UAE.

Verification of your documents

Before your presentation, it is good that you have all your documents at hand. These are visas, passports, and bank references, among others, specific to your bank.

Presentation of your documents

Depending on the ban,k you will be able to do the presentation of your documents online or physically. You must schedule an appointment quickly.

Follow up on the whole process of your bank account for non-residents in UAE

Once you have everything ready, it is good to follow up on the proces,s making sure that it goes through all the verifications and that your application is in order.

Eligibility Criteria for Non-Residents

When you want to open a bank account for non-residents in UAE you must understand the eligibility criteria. Therefore, we will outline the various aspects and criteria to consider when establishing an account in the UAE.

Documentation Requirements

Also, the requirements and eligibility to open a bank account for non-residents in UAE may vary from bank to bank, but generally, these are the following:

- Valid passport

- Proof of your address

- Bank reference letter

- Curriculum vitae CV

- Bank statements

- Completed application form

- Recent passport-size photos of yourself

Minimum Balance Requirements

The minimum balance required to open a bank account for non-residents in the UAE may vary depending on the bank you choose, but in general, there are several similarities among them. For that reason, see some of the general requirements that are requested:

Minimum monthly balance

Generally, you are required to maintain a balance in your bank account, which can be from AED 5,000 up to AED 50,000. This will depend on your type of account.

First deposit

Some banks usually require some type of deposit for the creation of your account; this may vary depending on your bank.

Average balance per month for your bank account for non-residents in UAE

Some UAE banks require you to have a balance per month, which can be around 10,000 USD.

Proof of Income

Finally, the minimum income is a requirement that you must have to open your bank account for non-residents in UAE. Let us see what you must follow:

Personal bank statements

In some cases, your bank may request a bank statement for the last three or six months from your account.

Income documents for your bank account for non-residents in UAE

In addition, you may be asked for some income documents, which could be receipts, employment contracts, or a tax return.

Conclusion

In conclusion, having a bank account for non-residents in UAE can become a tedious task, but with the necessary information, you will have the opportunity to open your first bank account for non-residents in UAE. Knowing already the types of banks, their eligibility, requirements, and other important aspects, you will be able to open your first bank account.

Remember that if you want more information on related topics, you can search for it in our blog section. Or if you want to call us to talk to us about your idea of opening a bank account for non-residents or any other requirement, you can do it at [email protected] or at +971 4 331 6688. We will be incredibly sad to miss you.

FAQs: Bank account for non-residents in UAE

Is it possible for non-residents in the UAE to create a bank account?

Yes, non-residents in the UAE may create a bank account there, usually a savings or fixed deposit account. However, they may have fulfilled higher balance requirements and have limited amenities available.

What papers do non-residents need?

A valid passport, a bank reference letter, evidence of a foreign address, such as a utility bill, and typically current bank statements. These indicate the source of income and documents that are frequently needed.

Do you need a UAE residency visa?

No, you don’t need a visa to have a bank account, although having one gives you access to additional services, such as credit cards and other banking possibilities.

What is the least amount of capital you need to keep in your account or deposit?

A non-resident account usually starts at AED twenty-five thousand, or more at the maximum level. Some banks have exceeding criteria even for a Basic current account.

Are there limits on the non-resident bank account types?

Yes, non-residents normally are prohibited from opening current accounts. They can only create savings or fixed deposit bank accounts. To open a current account, they usually need a UAE residency visa.