Navigating the intricacies of corporate tax registration UAE is a crucial step for businesses seeking to operate in compliance with the country’s taxation framework. Understanding the process and requirements for corporate tax registration is essential for companies aiming to establish a robust financial foundation.

In this article, we will delve into the key steps and considerations involved in registering for corporate tax in the UAE, providing businesses with a comprehensive overview and actionable insights to streamline the registration process. From documentation requirements to the submission process, this article will serve as a valuable resource for enterprises navigating the landscape of corporate tax registration UAE.

Needs for Corporate Tax Registration in UAE

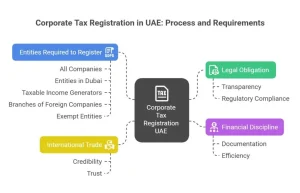

Corporate tax registration UAE is an imperative step for businesses. It helps align with the country’s commitment to fiscal transparency and regulatory compliance. The process fulfills essential requirements mandated by the UAE government. Furthermore, this ensures that companies contribute their fair share to the nation’s economic development.

One primary need for corporate tax registration is the legal obligation imposed on companies to comply with taxation laws. This helps promote a transparent financial ecosystem. Moreover, UAE corporate tax registration positions businesses to benefit from the country’s tax incentives and avoid potential penalties for non-compliance. It establishes a clear framework for companies to fulfill their tax obligations accurately and punctually. It fosters a harmonious relationship between businesses and the regulatory authorities.

Additionally, corporate tax UAE registration is a requirement for companies seeking to engage in international trade and bolster their credibility. Many international partners and stakeholders consider tax compliance a crucial factor when establishing business relationships. Therefore, corporate tax registration UAE becomes a strategic necessity for companies looking to build trust in the global business landscape.

Furthermore, the process of corporate tax UAE registration enhances financial discipline within businesses. It necessitates comprehensive documentation and a systematic approach to financial management, contributing to the overall efficiency of the company’s operations.

Who should register for Corporate Tax?

Various entities engaged in commercial activities must undergo the mandatory process of corporate tax registration Dubai. Understanding who should register is essential for businesses seeking compliance with the tax regulations. Here is a comprehensive list of entities that fall under the obligation for corporate tax registration UAE:

- All Companies: Regardless of size or structure, all companies operating in the UAE must register for corporate tax. This encompasses entities in free zones, mainland businesses, and those operating in designated economic zones.

- Entities in Dubai: Given Dubai’s status as a major business hub, corporate tax registration UAE is particularly pertinent for companies based in this emirate. The requirement applies uniformly to local Limited Liability Companies (LLCs), branches of foreign companies, or free zone entities.

- Entities Generating Taxable Income: Companies that generate taxable income, including profits from commercial operations, are subject to corporate tax registration. The annual turnover exceeding the specified threshold serves as a key determinant for this requirement.

- Different Corporate Structures: Partnerships, joint ventures, and other corporate structures are not exempt from Dubai corporate tax registration. Every entity, regardless of its organizational form, must initiate the registration process.

- Branches of Foreign Companies: Even if operating as a branch of a foreign company, entities are not exempt from the obligation of UAE corporate tax registration. Branches conducting business activities in the UAE must comply with the regulatory standards.

- Exempt Entities: While most entities are obligated to register, certain entities, such as government entities and nonprofit organizations, may be exempt from corporate tax. However, it is crucial for all businesses to carefully evaluate their eligibility for exemption.

Understanding the diverse landscape of entities obligated to do corporate tax registration UAE ensures comprehensive compliance. This list helps guide businesses through the registration process and contributes to Dubai’s economic growth.

The Procedure for Corporate Tax Registration in UAE

The procedure for corporate tax registration, including obtaining a tax registration number Dubai, involves several systematic steps to ensure compliance with taxation regulations. To initiate the process, businesses should start by gathering the requisite documentation. This typically includes legal entity documents, trade licenses, and other relevant certificates that establish the entity’s legal standing in UAE.

Subsequently, entities need to submit the completed application form for UAE corporate tax registration. This form, available through the tax authorities in the respective emirate, requires accurate and detailed information about the company’s structure, activities, and financial particulars. Providing precise information at this stage is crucial for a smooth and efficient registration process.

Moreover, upon application submission, tax authorities will review the provided information and may request additional documentation or clarification if needed. This stage emphasizes the importance of accuracy and transparency in the submission to avoid delays or complications.

Furthermore, upon successful scrutiny, the tax authorities will issue a tax registration number Dubai (TRN) to the entity. Conducting tax-related transactions and communicating with tax authorities requires the essential use of this unique identifier. Businesses must display the TRN on official documents, invoices, and any communication related to taxable transactions.

In addition, after obtaining the TRN, entities must continue their commitment to compliance by maintaining accurate records of financial transactions. Regular reporting and timely filing of tax returns are integral components of corporate tax obligations.

Check Tax Liability

Checking tax liability is a crucial step in the process of corporate tax registration UAE, particularly in Dubai. After obtaining the tax registration number (TRN), businesses need to diligently assess their tax obligations to ensure compliance with the country’s taxation regulations.

The first aspect involves a comprehensive review of the business activities and transactions to determine the applicability of corporate tax. This includes evaluating the nature of income, taxable transactions, and any exemptions or deductions available to the entity.

Simultaneously, entities must ascertain the correct tax rate applicable to their specific industry or business activities. Different sectors may have distinct tax rates, and accurate identification ensures precise computation of tax liability.

In addition to determining the tax rate, businesses need to assess any thresholds or exemptions that might apply. Some entities may be eligible for specific exemptions based on factors such as annual turnover or the nature of their operations. Understanding and correctly applying these exemptions contributes to an accurate calculation of tax liability.

It is imperative for businesses to maintain meticulous records of financial transactions, income, and expenses. This systematic record-keeping not only facilitates an accurate assessment of tax liability but also serves as a valuable resource during tax audits or inquiries.

Regularly reviewing and updating tax liability is an ongoing process, especially as business activities evolve. Staying informed about changes in tax regulations, exemptions, and thresholds is essential for businesses to adapt their tax planning strategies accordingly.

Fix the Entity type

Fixing the entity type is a pivotal aspect of the process of corporate tax registration process UAE, particularly in Dubai.

The first step involves a thorough review of the entity’s legal documents, such as the trade license and incorporation certificates. Confirming that the entity’s legal structure is correctly reflected in the tax registration in Dubai records is crucial during this assessment.

Entities must verify whether their legal structure, such as a Limited Liability Company (LLC), branch, or free zone establishment, is accurately designated in the tax registration in Dubai. Any inconsistencies in the entity type could lead to misunderstandings regarding tax obligations and may result in regulatory challenges.

In the event of a change in the entity’s legal structure, businesses must promptly update their tax registration Dubai records. If a company transitions from a sole establishment to an LLC, the company needs to accurately reflect this change to ensure compliance with the applicable tax regulations.

Additionally, businesses expanding or diversifying their operations should reassess their entity type in the context of tax implications. Changes in business activities, such as the introduction of new services or the establishment of branches, may necessitate adjustments to the entity type for accurate tax assessment.

Plan the Business Activity

Planning the business activity is a fundamental step in corporate tax registration UAE. After obtaining the tax registration number (TRN), businesses must strategically plan their operations to align with taxation regulations. This involves a proactive approach to understanding the tax implications of various business activities.

Entities should assess their planned business activities. They should consider factors such as the nature of income generation, potential taxable transactions, and applicable tax rates. This strategic planning ensures that businesses are well-informed about the tax obligations associated with their specific industry or services.

Furthermore, planning the business activity involves anticipating any changes in operations or expansions that might impact the tax liability. Businesses need to stay ahead by considering the introduction of new products or services, new branches, or more operations. Such foresight allows for accurate tax planning and compliance.

Regular reviews of the business plan in the context of tax regulations help entities stay proactive. This continuous assessment ensures that businesses can adapt their strategies in response to evolving tax laws, exemptions, or thresholds. It also helps foster a dynamic and compliant approach.

Prepare the required documents

Preparing the required documents is a crucial step in corporate tax registration UAE. Ensuring completeness and accuracy is essential for a smooth registration process. Here is a list of documents businesses should prepare:

- Legal Entity Documents: Gather all legal documents that establish the entity’s presence, including the trade license, memorandum of association, and articles of association.

- Financial Statements: Provide accurate financial statements, showcasing the entity’s financial position and activities.

- Tax Residency Certificate: If applicable, include the tax residency certificate issued by the competent authority in the entity’s home jurisdiction.

- Business Activity Details: Clearly outline the nature of the business activities, specifying the type of services or products offered.

- Trade License: Submit a copy of the valid trade license, verifying the entity’s authorization to conduct business in the UAE.

- Ownership and Shareholding Information: Include details of the entity’s ownership structure and shareholding pattern.

- Personal Identification: Provide copies of valid identification documents for key personnel, such as passport copies and Emirates ID.

By meticulously preparing and organizing these documents, businesses can expedite the corporate tax registration UAE process, demonstrating a commitment to compliance and transparency.

Register for Corporate Tax

To register for corporate tax in the UAE, businesses must follow a systematic approach after preparing the necessary documents. Firstly, initiate the registration process by submitting the required documentation to the relevant tax authorities. Upon submission, tax authorities will thoroughly review the provided information, ensuring its accuracy and completeness. If additional documentation or clarification is needed, businesses should promptly respond to facilitate a smooth registration.

Subsequently, businesses will be issued a unique tax registration number (TRN), a key identifier for all tax-related transactions. This TRN must be prominently displayed on official documents, invoices, and any communication pertaining to taxable transactions.

Registering for corporate tax establishes a formal acknowledgment of the entity’s tax obligations and initiates its inclusion in the tax system. Compliance with this process is essential for businesses to operate legally within the UAE’s taxation framework and contributes to the overall transparency and integrity of the business environment.

Conclusion

In conclusion, navigating the corporate tax registration process in the UAE is a structured journey that demands meticulous planning, accurate document preparation, and proactive engagement. By adhering to the step-by-step approach outlined, businesses can seamlessly integrate into the UAE’s taxation framework. The issuance of a unique tax registration number (TRN) marks a significant milestone, providing businesses with a distinct identifier for all tax-related transactions.

As entities display their TRN on official documents, invoices, and communications, they affirm their commitment to compliance and contribute to the transparency of the business landscape. Registering for corporate tax is not merely a legal formality; it is a strategic move that positions businesses to operate ethically and sustainably within the UAE, fostering a robust economic environment for all stakeholders.

If you are interested in learning more about this and other topics, we recommend that you check our insights. In there, you will find articles made to improve your knowledge on many topics. On the other hand, if you want to hire our services, just visit our contact section.

FAQs for Corporate Tax Registration UAE

Who is required to register for corporate tax in the UAE?

All Taxable Persons will be required to register for Corporate Tax and obtain a Corporate Tax Registration Number. Free Zone Persons are also included in it.

How can I apply for corporate tax registration?

You apply online via the Federal Tax Authority EmaraTax portal. Log in (or create a new account) → submit your registration application with supporting documents → receive registration/tracking number once approved.

What is the corporate tax rate in the UAE?

In the UAE, the standard corporate tax rate is 9 percent on taxable income for most companies. Moreover, qualifying Free Zone Persons may get a 0 percent rate on qualifying income. It is subject to conditions.

What documents are required for registration?

The documents required for registration include:

- A legal entity registration/licence

- Financial year‑end dates

- Shareholder/owner details

- Bank account info

- Evidence of business activities.

- For natural persons: proof of business turnover, business licence/permit, identity documents.

Are free zone companies subject to corporate tax?

Definitely! Free zone companies must register. If they qualify as a Qualifying Free Zone Person and meet conditions, they can benefit from a 0 percent rate on their qualifying income. However, non‑qualifying income is still taxed at 9 percent.

What are the deadlines for corporate tax registration?

As per FTA, a person whose total business turnover exceeds 1 million in a calendar year is considered a taxable person. If your turnover exceeds 1 million for the year 2024, then you must comply with Corporate Tax Registration by 31 March 2025